Bitcoin's Flash Crash: $1.27 Billion Liquidated – What's the Real Story?

Bitcoin took a dive, folks. Not a gentle dip, but a full-on nosedive from around $112,000 to below $106,000. The immediate fallout? Over $1.27 billion in leveraged futures positions got wiped out across the crypto exchanges. That’s a lot of zeros, and it’s a lot of pain for those who were overextended.

The data paints a clear picture: this was a long squeeze of epic proportions. Nearly 90% of those liquidations – $1.14 billion – were bullish bets gone bad. Shorts, on the other hand, only accounted for $128 million. The largest single liquidation event was a $33.95 million BTC-USDT long position on HTX. Someone had a bad day.

Diving Deeper into the Data: Where Did the Money Go?

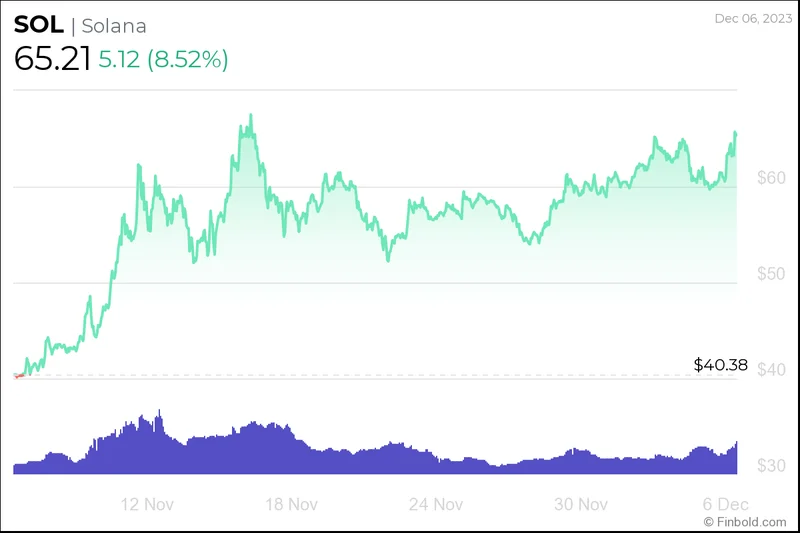

Hyperliquid led the pack in forced closures, racking up $374 million in liquidations. A staggering 98% of those were long positions. Bybit followed with $315 million, and Binance with $250 million. Ethereum and Solana weren't immune either, seeing combined liquidations topping $300 million. We're talking about a market-wide bloodbath. As reported by CoinDesk, BTC, ETH, XRP , SOL News: Traders Lose Over $1B in 24 Hours as Longs Get Crushed, the liquidations impacted a wide range of cryptocurrencies.

Now, here's where things get interesting. What triggered this cascade? The immediate narrative points to traders getting skittish ahead of the Federal Reserve’s rate decision. Makes sense on the surface – uncertainty breeds fear, and fear leads to selling. But let's not forget the broader context. The U.S. government shutdown is now tied for the longest in history (35 days, matching the 2018-2019 record). And the U.S. Dollar Index (DXY) is above 100 for the first time since August 1st. That's a triple whammy of potential headwinds for risk assets like Bitcoin.

The DXY is a particularly crucial indicator. A rising dollar typically puts pressure on BTC and tech stocks. Why? Because a stronger dollar makes it more expensive for international investors to buy dollar-denominated assets. It’s a simple supply-and-demand equation, but it’s one that’s often overlooked in the crypto hype machine.

The Fed, the Dollar, and the Shutdown: A Perfect Storm?

I've looked at hundreds of these market corrections, and this particular confluence of factors is unusual. The shutdown adds a layer of macroeconomic uncertainty that's hard to quantify. It’s not just about government employees not getting paid; it’s about the potential for cascading effects on the broader economy. (Think delayed tax refunds, reduced government services, and a general sense of unease.)

The question is, how much of this sell-off was driven by genuine fear and how much was simply algorithmic trading gone wild? It’s tough to say for sure, but the sheer volume of liquidations suggests that automated systems played a significant role. These systems are designed to detect and react to market volatility, and when enough of them start selling, it can create a self-fulfilling prophecy.

Bitcoin is approaching its lowest price since the end of June, nearing $103,000. Is this the bottom? Maybe. Maybe not. But one thing is clear: the market is on edge. Traders are bracing for more volatility, and anyone who's overleveraged is playing a dangerous game.

Now, here's my methodological critique: How accurate are these liquidation figures? The numbers come from the exchanges themselves, and while they have a vested interest in transparency (to maintain trust), there's always the potential for discrepancies. Are all exchanges reporting liquidations in the same way? Are there any hidden fees or charges that aren't being disclosed? These are questions that deserve further scrutiny.

A Brutal Reminder of Crypto's Realities

That billion-dollar liquidation event? It's a stark reminder that the crypto market is not immune to the forces of traditional finance. The Fed's decisions, the strength of the dollar, and even the antics of politicians in Washington can all have a significant impact on Bitcoin's price. And anyone who forgets that is bound to get burned.