Solana's Dip: A Buying Opportunity or a Sign of Things to Come?

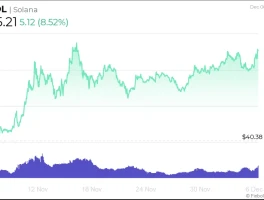

Solana's recent price wobble, dipping below $180 and currently hovering around $175 (a 6.4% daily decline), has the crypto-sphere buzzing. On the one hand, you've got analysts pointing to "risk-off sentiment" dragging down the whole market. On the other, the Solana faithful are digging in, fueled by news of institutional inflows into Solana ETFs. So, what's the real story?

Let's start with the numbers. A nearly 12% correction in a week isn't exactly a cause for celebration. But, context matters. Solana has been on a tear, and a pullback was almost inevitable. The crucial question is whether this is a temporary blip or the start of a more sustained downtrend. The technicals suggest a mixed bag. The RSI (Relative Strength Index) is nearing oversold territory, which could signal a buying opportunity. But a decisive break below the $172 support level could open the floodgates to further declines, potentially down to $157 or even $142.

The bulls, meanwhile, are clinging to the $199 million in institutional inflows into Solana ETFs in a single week. Solana Price Drops Below $180 Despite $199M ETF Inflows, What’s Behind the Decline? - TradingView Total assets under management (AUM) across Bitwise, Grayscale, and 21Shares now exceed $500 million. That's a significant vote of confidence, no doubt. But, and this is a big "but," inflows don't guarantee price appreciation. They simply mean institutions are allocating capital. Whether that capital stays put—or gets reallocated at the first sign of trouble—remains to be seen. And this is the part of the report that I find genuinely puzzling. Why are institutions pouring money into SOL ETFs even as the price action turns negative? Are they playing a longer game, or are they simply late to the party?

Lark Davis, a prominent crypto analyst, maintains that Solana is "winning" against Ethereum in terms of speed, scalability, and user growth. And there's data to back that up. Solana's annualized revenue is reportedly $2.85 billion, growing nearly 30%—to be more exact, 28.6%—faster than Ethereum's early-stage growth. Western Union is even building a stablecoin on Solana for global remittances. But "winning" in tech doesn't always translate to "winning" in the markets. Remember Betamax? Superior technology doesn't always equal market dominance.

The Revenue Mirage

The $2.85 billion revenue figure is eye-catching, but it's crucial to understand what it represents. Is it transaction fees? Staking rewards? The composition of that revenue stream matters. A high percentage of transaction fees would indicate strong organic demand. A reliance on staking rewards, on the other hand, could be less sustainable. Details on the revenue breakdown remain scarce, but the market's reaction suggests some skepticism.

Consider this: Solana needs to defend the 200-day moving average at $179.78 and reclaim the $189–$200 range to restore short-term bullish momentum. That's a fairly narrow band of resistance, but it's proving to be a tough nut to crack. The fact that the price is struggling to break through suggests that the market isn't entirely convinced by the "Solana is winning" narrative. It's like a company reporting record sales, but its stock price dips because investors are worried about rising costs or shrinking margins. The top-line number looks great, but the underlying financials tell a different story.

Is This Just a Paper Gain?

Ultimately, Solana's fate hinges on more than just institutional inflows or technical indicators. It depends on its ability to continue attracting users, developers, and real-world applications. The Western Union stablecoin is a promising development, but it's just one piece of the puzzle. Solana needs to demonstrate that it can deliver on its promise of speed and scalability without sacrificing security or decentralization. Until then, the market will likely remain cautious, and price swings like this one will be the norm. I've looked at hundreds of these situations, and this particular setup is unusual. The market is pricing in potential future growth, but discounting the current revenue figures.