So, a Wall Street firm just dropped nearly half a billion dollars on Solana.

Let that sink in. Sharps Technology, a name you probably hadn't heard of until yesterday, decided to scoop up 2 million SOL, worth a cool $440 million. And now, the entire crypto world is supposed to fall over itself celebrating "institutional adoption." Give me a break. This isn't a revolution; it's just the big money finally showing up to a party that's been raging for years, and they expect us to clap like seals...

They’re not holding the keys themselves, offcourse. Heavens, no. That would be too risky, too crypto. Instead, they’ve tapped Coinbase to be their official digital piggy bank, their crypto-custodian. And why? So they can "stake" their massive pile of SOL and rake in an estimated $30 million a year in rewards.

Let's "deconstruct," as the academics would say, the PR-speak from Sharps' boss, James Zhang. He gushed about Coinbase's "institutional-grade infrastructure, deep liquidity, and competitive pricing." Here’s the Nate Ryder translation: "We're terrified of this volatile internet money, so we're paying the biggest, most regulated guy in the room to hold it for us so we don't screw it up. This way, we can tell our own investors we're being responsible while still gambling on a coin that can swing 20% before lunch." It’s the crypto equivalent of putting a spoiler on a minivan. It looks sporty, but it’s still just a safe, boring way to get from A to B.

The Echo Chamber Gets Louder

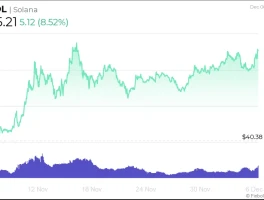

As soon as the news hit, the hype machine roared to life, right on cue. An analyst from Cryptonews—a publication I'm sure is entirely unbiased—promptly declared a long-term price target of $600 for Solana (Solana Price Prediction: Public Company Taps Coinbase to Buy Millions in SOL – Wall Street is Here - Cryptonews). Why? Because of "institutional demand," naturally. It’s a beautifully self-fulfilling prophecy, isn't it? An institution buys, which creates the story of institutional demand, which is then used to predict more institutional demand. It's a snake eating its own tail, and we're all just supposed to marvel at the circle.

Then come the chart-gazers with their technical analysis, pointing to a "bullish ascending price channel." They've identified $210 as a "key demand zone." This is a bad look. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire of market psychology. What they're really saying is, "Here's the line where big money has their buy orders set, so please, retail investors, don't you dare let it fall below that, or you'll ruin the whole plan."

It all just feels so... orchestrated. Sharps makes a huge, press-release-worthy purchase. Coinbase legitimizes it. Analysts provide the astronomical price targets. Is anyone actually thinking for themselves here? Or is this just the next phase of the game, where the Wall Street playbook gets copy-pasted onto a supposedly decentralized world? What happens to all this "institutional demand" the second the market turns and these guys need to protect their quarterly earnings?

This whole thing is like watching a flock of penguins. One jumps into the water, and after a moment of hesitation, the rest all waddle in right behind him, assuming he knows where the fish are. Sharps just made their big splash. Now we're supposed to believe they're financial geniuses who've discovered a secret ocean of wealth, and not just the next penguin in line hoping they don't get eaten by a seal.

So, What's the Real Game Here?

Let’s be brutally honest. Sharps Technology isn't some visionary firm betting on the future of decentralized applications. They're a Wall Street company managing a treasury. Their job is to make money, not to change the world. Buying $440 million in SOL and immediately staking it for a 6.8% yield is a treasury management decision dressed up in a crypto hoodie. The $30 million in annual yield is a fantastic hedge. It provides a steady, predictable income stream that looks great on a balance sheet, all while they sit on an asset they hope will triple in value.

It's a brilliant move, from a purely cynical, capitalist perspective. They get the upside of a massively volatile asset and the downside protection of a yield that rivals traditional investments. But does this signal that Solana is "going to $600"? Or does it just signal that financial engineers have found a new, exciting asset class to play with?

I keep wondering what the conversation was like in that boardroom. Was it a passionate debate about Solana’s superior transaction speed and its potential to dethrone Ethereum? Or was it a cold, calculated discussion about risk-adjusted returns and treasury diversification? My money is on the latter. And if that's the case, their loyalty to Solana is only as deep as their profit margin. The moment a better, safer, or more lucrative play comes along, they'll be gone. Then again, maybe I'm the crazy one here, still clinging to the idea that crypto was supposed to be about something more than just making the rich richer.

Don't Drink the Kool-Aid

Look, this isn't adoption. It's assimilation. Crypto isn't changing Wall Street; Wall Street is colonizing crypto. They’re taking our weird, chaotic, decentralized world and slapping their logos, their custodians, and their press releases all over it until it's safe and sterile enough for their balance sheets. Sharps Technology's big buy isn't a victory for Solana. It's a sign that the suits have arrived, and they're here to turn our revolution into their next quarterly earnings report. We're not the pioneers anymore; we're just the exit liquidity.