Arista's Stock Dive: Don't Fall For the Hype, It's All Smoke and Mirrors

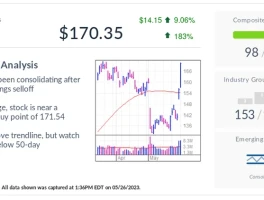

So, Arista Networks (ANET) – the darling of the data center crowd – takes a header after posting decent Q3 numbers. Shares down 10%? Please. Anyone surprised by this hasn't been paying attention.

Year-to-date, the stock's up nearly 40%. That's your first clue. What goes up must come down, and in the tech world, gravity hits hard.

Numbers Game

Okay, let's break down the "good" news. Revenue up 27% year over year. Sounds impressive, right? But here's the thing: these companies are masters of illusion. They massage the numbers, spin the narrative, and leave out the inconvenient truths. What about next quarter? What's the real growth potential, not just the quarterly bump? Nobody seems to be asking the right questions.

And AMD? They beat expectations too, apparently. Adjusted diluted earnings per share: $1.20 (analysts wanted $1.17). Revenue: $9.25 billion (they guessed $8.74 billion). So what? This is still just pocket change compared to the big players.

Data center revenue for AMD: $4.34 billion (estimate: $4.14 billion). Okay, a beat is a beat. But how much of that is sustainable, and how much is just riding the AI wave? Let's be real, everyone's slapping "AI" on their products these days to get a quick pump, even if they're just selling glorified calculators.

Their Q4 guidance is supposedly strong, $9.3 billion to $9.9 billion. But even that wasn't enough to stop the stock from dipping 2% in after-hours trading. The market ain't stupid. It sees through the BS.

The AI Mirage

AMD's got a "megadeal" with OpenAI, expected to deliver "tens of billions of dollars in revenue." Oh, really? Tens of billions? That's awfully specific, ain't it? Where's the actual contract? Where's the guarantee? It’s all just hype to juice the anet stock price today and nvidia stock.

And Oracle is supposedly deploying 50,000 of AMD's new chips in data centers. Great. But what if those chips underperform? What if NVIDIA comes out with something better next week? What if the whole AI bubble bursts? Then what?

Morgan Stanley's analyst Joseph Moore says the focus should be on AMD's MI450 chips. He's "excited to see what the company can do." Excited? He's an analyst, not a cheerleader. His job is to be skeptical, to poke holes in the story, not to blindly accept the PR spin.

He does at least admit that relying on cloud providers creates "some uncertainty." No kidding.

To drive share gains, AMD needs to offer a better ROI than NVIDIA. But customers still have questions about that, given lower rack density and ecosystem issues. Translation: AMD's tech might be cheaper, but it's also more of a pain in the ass to implement.

The Bigger Picture

The article mentions "5 AI Infrastructure Stocks Enabling the Next Wave of Growth," but then hides them behind a paywall. This is how they get you. They dangle the carrot, then force you to pay to see it. Give me a break. You can read more about these 5 AI Infrastructure Stocks Enabling the Next Wave of Growth here.

And let's not forget the constant stream of "analyst upgrades" and "price target hikes." These guys are all in the same club. They scratch each other's backs, pump up the stocks, and then dump them on unsuspecting retail investors.

It's all a rigged game.

So, What's the Real Story?

This isn't about Arista's Q3 results or AMD's AI deals. It's about the endless cycle of hype and disappointment in the tech world. It's about companies promising the moon, delivering a pebble, and then blaming the market when their stock tanks. It's about the analysts who are supposed to be watchdogs but are really just lapdogs. And it's about the retail investors who keep falling for the same old tricks, offcourse. Don't be one of them.