[Generated Title]: Arista's AI Hype Train: Revenue Growth Masks a Looming Volatility Bomb

Arista Networks (ANET) saw its stock take a 10% hit in after-hours trading despite reporting Q3 2025 results that, on the surface, looked pretty good. Revenue jumped 27% year-over-year, and they beat EPS estimates by $0.04, landing at $0.75. Shares are still up nearly 40% YTD, so it's not exactly a fire sale, but the market's clearly seeing something it doesn't like.

The AI Mirage?

The company is heavily pushing its AI networking narrative, projecting over $1.5 billion in AI-related revenue for 2025. CEO Jayshree Ullal even called it a "once-in-a-lifetime opportunity." And yes, they're making headway with hyperscalers, supposedly displacing InfiniBand with Ethernet. Okay, fine. But let's dig into the numbers.

Arista highlighted that two "AI Titan" customers account for more than 10% of sales each. That's great for top-line growth, until it isn't. What happens when those "Titans" decide to pull back spending, or even worse, switch to a competitor? The stock's reaction suggests investors are asking the same question. While they tout expanding their customer base to 25-30 deploying Arista's AI networking solutions, the concentration risk remains a glaring vulnerability.

Deferred revenue is sitting pretty at $4.1 billion, fueled by multi-quarter service contracts and, of course, AI projects. But here's the kicker: management explicitly warned about volatility in billings due to acceptance clauses and new product rollouts. In other words, that $4.1 billion isn't a guaranteed goldmine; it's subject to change. It's like counting chickens before they hatch, but with the added risk that some of those eggs might be rotten.

Arista's operating margin hit a record 48.8% in Q2, which Ullal attributed to efficiency and scale, not just pricing power. CFO Chantelle Breithaupt guided for a 47% operating margin for Q3. Gross margins are expected to remain around 64%. The question is, can they sustain these levels as they ramp up new product introductions? Or will those margins get squeezed as competition intensifies, particularly from companies like AMD and Nvidia stock, who are making moves in the data center space? The chatter on X (formerly Twitter) hints at concerns about alternative networking solutions being adopted by major tech players.

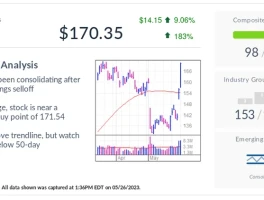

Here's where I find this gets interesting. The stock price closed at $153.54, up over 50% in the last year. Analysts are mostly bullish, with a median price target of $175.00. Morgan Stanley, JP Morgan, and Goldman Sachs all have "Overweight" or "Buy" ratings. But here's the rub: insiders are selling. A lot. Ullal alone has sold over 7 million shares in the last six months for almost a billion dollars. Kenneth Duda, the President and CTO, has unloaded 440,000 shares. What do they know that the analysts don't?

The Insider Signal

Now, insider selling isn't always a red flag. Maybe they're diversifying their portfolios, buying a yacht, or paying for their kids' college. But the scale of the selling is hard to ignore. When the people who know the company best are cashing out, it raises serious questions. Are they seeing cracks in the AI growth story that the rest of us aren't? Are they anticipating a slowdown in hyperscaler spending? Or are they simply taking profits after a massive run-up in the anet stock price?

Even members of Congress have been trading ANET stock. Is this a sign of confidence, or are they just following the hype? It's hard to say, but it adds another layer of complexity to the analysis.

The company's guidance for Q4 revenue is $2.30B-$2.40B, compared to the analyst consensus of $2.34B. That's not terrible, but it's not exactly blowing the roof off either. And given the volatility warnings and the insider selling, I'm inclined to be cautious.

Follow the Money (Out the Door)

Arista is riding the AI wave, and they're doing a good job of convincing investors that they're a key player. But the underlying data suggests a more nuanced picture. Customer concentration, deferred revenue volatility, and heavy insider selling all point to a potential storm brewing beneath the surface. The anet stock price today might still be up, but the smart money seems to be heading for the exits.