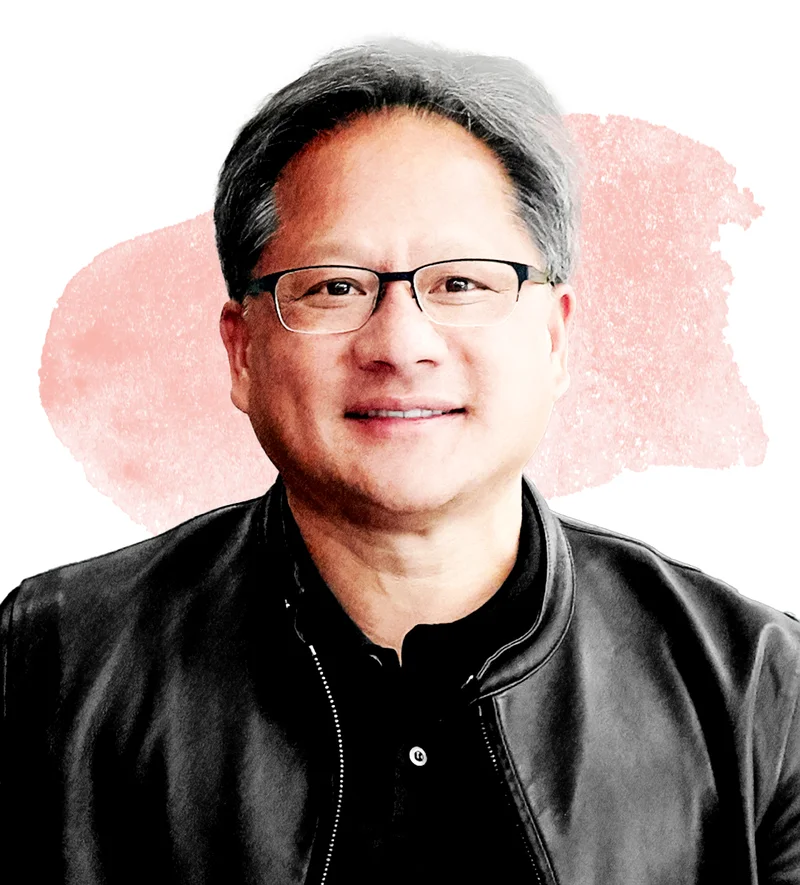

There are two distinct narratives circulating about Nvidia right now. The first is the one delivered by CEO Jensen Huang from the stage of the GTC 2025 conference, a narrative of unprecedented, almost unimaginable, growth. The second is the one written in SEC filings and brokerage statements, a narrative of insiders, led by Huang himself, liquidating stock at a rate never seen before in the company’s history.

One of these narratives is a forecast. The other is a record of action. My job is to determine which one carries more weight.

The public story is, admittedly, intoxicating. Standing under the spotlights, Huang didn't just offer guidance; he dropped a figure so colossal it almost defies belief. He claimed Nvidia has visibility into a cumulative half a trillion dollars of demand for its current Blackwell and next-generation Rubin chips through 2026. "This is how much is on the books," he stated, a declaration of certainty that sent `NVDA stock` surging another 10%.

To put that number in perspective, the company’s revenue for the last twelve months was $165 billion. The projection Huang laid out represents a demand pipeline three times that size, all materializing over the next five quarters. It’s a statement that implies the AI gold rush isn't just continuing—it's accelerating into a new, frantic phase. The market, naturally, ate it up. Why wouldn’t it? The numbers seem to support the story. Even at its nosebleed valuation, the stock trades at a forward P/E of 33, a figure that seems almost reasonable if you believe earnings will grow at twice that rate.

The Half-Trillion-Dollar Proclamation

Let’s be precise about what was said. The quote was: "I think we're probably the first technology company in history to have visibility into half a trillion dollars of cumulative Blackwell and early ramps of Rubin through 2026." I’ve analyzed hundreds of earnings calls and keynote addresses, and the phrasing here is what I find genuinely interesting. The use of "visibility" is standard corporate-speak, but coupling it with "on the books" is an attempt to frame this forecast as something closer to a backlog of locked-in purchase orders. It’s a subtle but powerful rhetorical choice designed to quell any fears of a demand bubble.

This is the narrative that has propelled Nvidia into the stratosphere, making it the first company to breach a $5 trillion market cap. It’s a story of being the sole purveyor of shovels in a world-changing gold rush, with the world's richest companies—the "Magnificent Seven"—lining up to buy every tool you can make. From a $1 billion investment with Nokia to build AI-powered 6G networks to a partnership with Oracle for a Department of Energy supercomputer, the applications seem endless.

The market has priced `Nvidia` as if this future is not just possible, but inevitable. The consensus revenue estimate for next year sits at $278 billion, and even that is now considered low. The bull case is simple: this time is different. The scale of the technological shift to AI is so immense that traditional valuation metrics and growth ceilings simply don't apply. But is that what the company's own leadership believes? Their financial actions suggest a far more complicated, and perhaps contradictory, view.

The Billion-Dollar Dissent

While the market was cheering the $500 billion forecast, a different set of numbers was quietly being finalized. News broke that Nvidia CEO Jensen Huang cashes out $1 billion as AI chip demand fuels massive stock rally. This wasn't a one-off transaction; it was the culmination of a plan initiated in March to sell up to six million shares. The initial value of the shares slated for sale was $865 million, but the stock's relentless climb pushed the final tally well past the billion-dollar mark.

An executive selling stock is, in itself, unremarkable. They have bills to pay, foundations to fund (he has donated over $300 million this year), and portfolios to diversify. It's financial prudence. But the context and scale here demand scrutiny. Huang isn't the only one selling. Nvidia insiders collectively unloaded nearly $1.5 billion of stock in the third quarter alone. For the full year of 2024, that figure surpasses $2 billion. This is a significant escalation from the $462 million they sold in all of 2023. In fact, insider sales in 2024 are over four times the 2023 total—to be more exact, a 332% increase based on these figures.

This pattern is the analytical equivalent of a flashing red light on the dashboard. Think of it this way: an executive selling stock is like a master shipbuilder selling the personal yacht he built. It's his to sell. But when the shipbuilder, his chief engineer, and the entire navigation crew all start selling their personal yachts at the same time, you have to start asking questions about the seaworthiness of their next big vessel. It doesn't mean the ship will sink, but it certainly suggests they aren't as confident in its unsinkable nature as their public statements would have you believe.

This brings us to the core discrepancy. We are being asked to believe in a future of unprecedented, guaranteed demand while the very people with the most intimate knowledge of that demand are reducing their exposure at an accelerated pace. If you had a guaranteed half-trillion-dollar pipeline materializing over the next 15 months, would this be the moment you choose to make your largest-ever stock sale? What information is contained within that sales data that isn't present in the GTC keynote?

The Data Has a Dissenting Opinion

The bull case for Nvidia rests entirely on the idea that its monopolistic grip on high-end AI chips will continue, that its astronomical gross margins (currently around 70%) are sustainable, and that the demand curve will not just continue but steepen. The insider selling doesn't necessarily negate this, but it introduces a critical element of doubt. It’s a vote of no-confidence, not in the company's survival, but perhaps in its current valuation.

The argument that these are pre-planned 10b5-1 sales offers only partial cover. An executive sets up a plan to sell shares in the future precisely because they anticipate a good time to sell. The timing of this plan's execution, right on the heels of the most bullish forward-looking statement in the company's history, is either a remarkable coincidence or a remarkably shrewd move to liquidate shares at a moment of peak market euphoria.

As an analyst, when I see a conflict between a narrative and a set of transactions, I trust the transactions. Words are cheap; a billion-dollar sale is not. The public ledger shows a $500 billion forecast. The private ledger of the CEO's personal finances shows a $1 billion exit. While the market is buying the story, `Nvidia CEO Jensen Huang` and his team are selling the stock. That’s the most important data point of all.