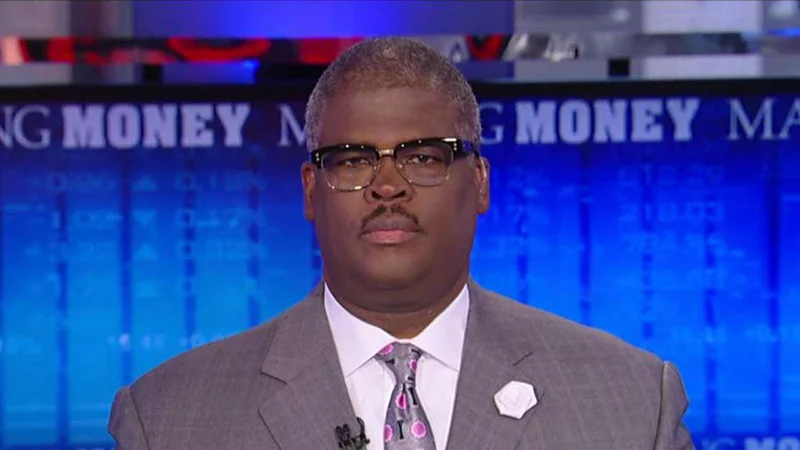

I spend my days thinking about the future. I’m talking about AI, quantum computing, the very fabric of our digital existence. So, you might find it strange that I’ve recently become fascinated by something that, on the surface, seems incredibly traditional: a financial news show on Fox Business. But when you watch Making Money with Charles Payne, you start to realize you’re not just watching a man talk about stocks. You’re witnessing a profound cultural shift in real-time.

I have to admit, when I first tuned in, I was skeptical. The world of finance often feels like a closed-off cathedral, with its own high priests speaking in a language of derivatives and P/E ratios, intentionally obscure to the rest of us. But what I saw in Charles Payne wasn't a gatekeeper; it was a translator. Here was a man standing in front of the dizzying, relentless scroll of the stock ticker—that river of green and red data that governs so much of our world—and he was speaking directly to the person on the other side of thescreen, the person trying to build a future, secure their family, and make sense of it all. This isn't just about money. This is about agency.

What does it mean to have agency in the 21st century? Is it just about voting or having a voice online? Or is it about understanding the invisible systems that shape our lives? Payne seems to operate on the belief that true empowerment comes from literacy, and in our world, financial literacy is no longer optional.

The Signal in the Noise

Imagine trying to navigate a hurricane using only the sound of the wind. That’s what investing feels like for most people. We’re bombarded with a constant, deafening roar of information—breaking news, algorithmic trades happening in microseconds, hot tips from a cousin’s friend, and the endless chatter of social media—and the sheer volume of it all is paralyzing, it’s designed to make you feel small and powerless against forces you can’t possibly comprehend. This is where Payne’s role becomes so incredibly vital. He’s not just another voice adding to the noise; he’s trying to be the signal.

His show on Charles Payne Fox Business acts as a kind of public workshop. He’s not just giving you a fish; he’s trying to teach you how to fish in these turbulent digital waters. This is a crucial distinction. The conversation isn't just a one-way street of Charles Payne stock picks. It’s a dialogue built around a core philosophy, one he lays out in his books. He’s building a framework for thinking, a mental model for engaging with a system that has historically profited from the public's confusion.

This approach is, in its own way, a revolutionary act. For generations, Wall Street was a fortress. You paid a professional to manage your money because the language was too complex, the stakes too high. Payne is essentially handing out keys to the fortress. He’s taking complex ideas like "market sentiment"—in simpler terms, the collective mood or feeling of investors, which can be as fickle as the weather—and breaking them down into digestible, actionable insights. But does this democratization of financial knowledge actually level the playing field, or does it just invite more people into a game where the house still has the edge?

Building the "Unbreakable Investor"

This brings us to the central thesis of his work: the concept of the Unbreakable Investor. When I first heard the term, I honestly just sat back in my chair and thought, "That's a brilliant piece of branding." It sounds like something out of a superhero movie. But the more I listened, the more I realized it’s a profound statement about human psychology in an age of volatility. It’s not about never losing; it’s about having the conviction and the knowledge to not be broken by a loss. It’s about resilience.

This idea is so much bigger than just the stock market. It’s a philosophy for our time. We are all living through unprecedented technological and social disruption. The future I study and write about is one of immense change. The ability to withstand shocks, to learn from failure, and to maintain a long-term vision is going to be the single most important skill for navigating the next century. Payne is applying this futurist mindset to personal finance. His books, like Unbreakable Investor, aren't just another Charles Payne book on making money; they're manuals for psychological fortitude.

This is the kind of paradigm shift that reminds me of the printing press. Before Gutenberg, knowledge was held by a select few. The printed word shattered that monopoly and unleashed centuries of progress. In a similar vein, communicators like Payne, by leveraging mass media, are breaking the monopoly on financial expertise. The details of who is Charles Payne—his age, his height, his education—are less important than the movement he represents: the radical idea that everyone deserves a seat at the table. Of course, with this power comes immense responsibility. Guiding millions of people in their financial decisions is a heavy weight, and the line between empowerment and reckless encouragement can be perilously thin.

The New Literacy for a New World

So, where does this leave us? It leaves us looking at a man who has become a symbol of something far greater than his own Charles Payne net worth. His true value can’t be measured in dollars; it’s measured in the number of people who feel a little less intimidated, a little more in control of their own destiny.

In the future I envision, understanding the systems that power our world—be they technological algorithms or financial markets—won't be a niche hobby. It will be the new baseline for what it means to be an engaged citizen. Charles Payne, whether he intends to or not, is on the front lines of teaching that new literacy. He’s showing people that the complex, intimidating world of finance isn't some unknowable force of nature. It's a system built by people, and with the right tools and the right mindset, it can be understood by people. And in that understanding lies the seed of real, tangible power.