A Tale of Two Fords: The Record-Breaking Engine and the Single Broken Part

I’ve spent my career studying complex systems—the intricate dance of code, hardware, and human ingenuity that powers our world. And when I look at Ford’s latest earnings report, I don’t just see numbers on a spreadsheet. I see a fascinating, real-world stress test of one of the most complex systems on Earth: a legacy automaker transforming itself in real-time. The story that unfolded this week, where Ford beats on earnings but lowers 2025 guidance after supplier fire, is a perfect paradox, a tale of a company firing on all cylinders while simultaneously being tripped up by a single, random spark hundreds of miles away.

On one hand, you have a set of numbers that should have had champagne corks flying in Dearborn. A quarterly revenue record of $50.5 billion. Net income soaring to $2.4 billion. Wall Street was looking for 36 cents a share; Ford delivered 45. This isn’t just a good quarter; it’s a validation of the entire “Ford+” strategy CEO Jim Farley has been evangelizing. It’s proof that the core machine—the part of the company that builds the trucks and commercial vans that are the backbone of the American economy—is an absolute powerhouse.

Just look at the breakdown. The Ford Pro division, which handles commercial vehicles, printed nearly $2 billion in profit. Ford Blue, the traditional gas and hybrid arm, added another $1.5 billion. Together, that’s a staggering amount of cash flow generated by building the vehicles people and businesses are desperate to buy right now. This is the engine, humming with a power and efficiency that many had written off just a few years ago.

Of course, that engine is also funding the future. The Model e division, Ford’s electric dream, posted a $1.41 billion loss. Skeptics will point to that number as a sign of failure, but I see it as the massive, necessary cost of building a new world. You can’t construct the factory of tomorrow without pouring the concrete today. That loss is an investment, a down payment on relevance in the next century, paid for by the immense success of the present. When I first saw these results, I honestly just sat back in my chair, impressed. This is exactly what a healthy transition is supposed to look like: the old world funding the new.

The Billion-Dollar Butterfly Effect

And then, the butterfly flaps its wings. A fire at an aluminum supplier’s plant in New York. A single piece of machinery—a “hot mill”—goes down. Suddenly, the entire narrative shifts. Because of that one incident, Ford is losing an estimated 100,000 high-profit trucks and SUVs from its production schedule this year. The result? They had to slash their full-year earnings guidance by a billion dollars. When I saw that news, my first thought wasn't that Ford was in trouble, but rather, "This is a brutal, masterclass-level lesson in supply chain physics."

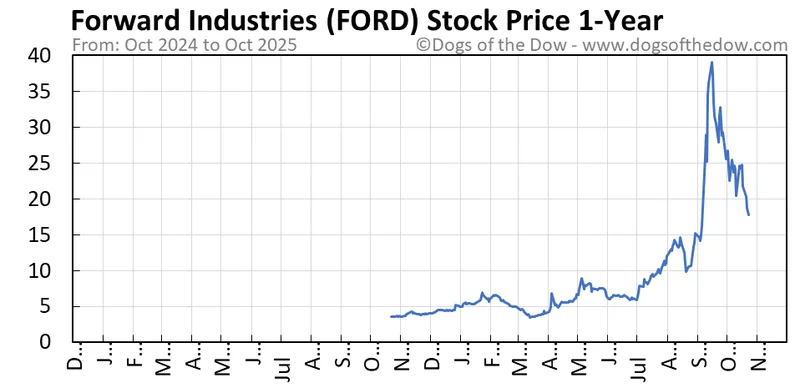

This is where things get truly interesting. The stock market, in its infinite short-term wisdom, initially sent the `ford stock price` tumbling. It’s a classic knee-jerk reaction: guidance down, sell. But what are we really looking at here? Is this a failure of Ford's strategy, or a testament to the terrifying fragility of our hyper-efficient global manufacturing network? This fire is like a single, perfectly aimed rock hitting the fuel line of a Formula 1 car that was in the middle of setting a lap record. The engine is still a marvel of engineering, the driver is still brilliant, but a random piece of debris from the outside world has forced it into the pits. The car isn't broken; its supply line is.

Think about the sheer complexity of it all—the choreography of thousands of suppliers and millions of parts all converging with just-in-time precision is a modern miracle, and it means the gap between a record-breaking quarter and a billion-dollar problem can be a single, unfortunate spark. This isn't a Ford problem; it's a 21st-century manufacturing problem. How do you build resilience into a system that is predicated on ruthless efficiency? Can you ever truly de-risk a supply chain that spans continents?

This is why the reaction from RBC Markets analyst Tom Narayan was so sharp. He pointed out that if you filter out the noise—the fire and some changing tariff costs—Ford’s guidance was effectively a raise. He’s seeing the signal through the smoke. The company’s core operational strength isn't just intact; it's improving so much that it took a literal disaster to obscure the progress. The `ford motor company stock` might fluctuate day to day, but the underlying narrative of the Ford+ plan seems to be working exactly as designed.

The Signal in the Smoke

So let's be perfectly clear. The market's initial panic was a misreading of the situation. It mistook an external shock for an internal weakness. This fire doesn't reveal a flaw in Ford's vision; it reveals the strength of that vision by showing just how powerful the company's core business has become. It took a catastrophe to knock them a single step back from what would have been an even more triumphant year. Ford is proving it can weather the storm, planning to recoup half the lost production next year by adding a thousand workers. That’s not the move of a company in crisis; it’s the move of a heavyweight taking a punch, shaking it off, and getting right back in the fight. The real story isn't the fire; it's the incredible strength of the machine that the fire failed to stop.